Disclaimer: Banks tend to update their forms, this form is neither a complete form nor updated one. Please refer the bank website for any query/ information. This image is only for educational purposes.

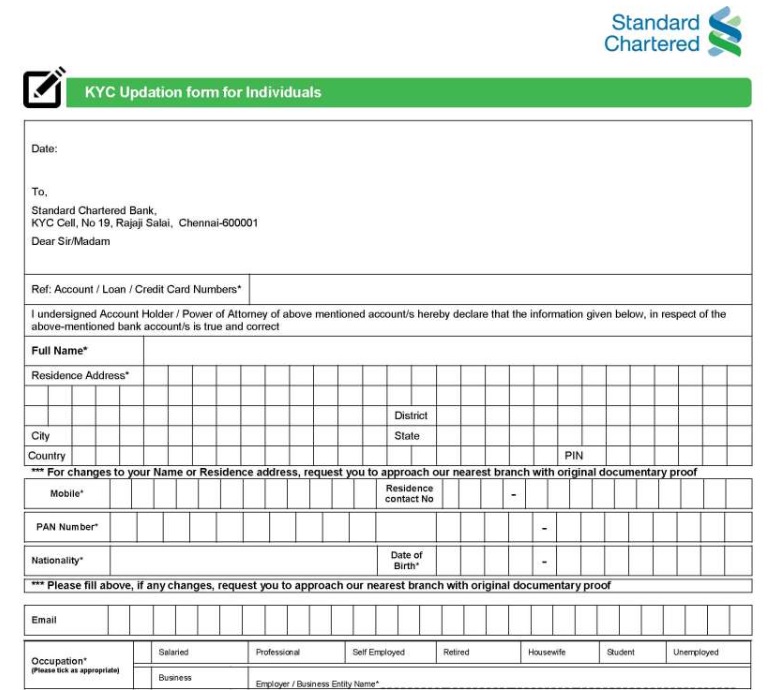

Know your customer or KYC form is an integral part of account opening be it individuals or corporate clients. What is in a KYC Form? The fields of a KYC form reflect that banks want to ascertain the source of income of its client. Further, they also want to know your business linkages e.g. supplies and buyers. Your mode of transactions.

Know Your Customer KYC Form Purpose and Uses:

Why do banks need to fill in Know Your Customer KYC Form? They already have our account opening form. Our ID document. Our pay slip or business documents as the case may be. Then, still they are curious for more financial, reputational and risk oriented information from us. Read out the fields of any KYC form of a bank. It will disclose and satiate your thirst for the answers. Remember that all the information banks require is needed for screening. One way or the other, they need to comply to the regulations set forth by FATF( Financial Action Task Force). The banks need to make sure that the money they are dealing with is clean money.

What if Banks Don’t Obtain Know Your Customer KYC Form:

The banks function under a critical and hawkish scrutiny of their central/ federal banks. They need to comply all regulations. The central banks issue minimum required set of information/ scrutiny for account opening. The banks have to simply comply it. No relaxation of any sort. State Bank of Pakistan has issued various instructions for obtaining minimum information as envisaged in:

- Anti-Money Laundering, Combating the Financing of Terrorism & Countering Proliferation Financing (AML/CFT/CPF) Regulations

- Guidelines on Risk based Approach for banks/DFIs/MFBs

- AML/CFT/CPF Regulations – Guidelines on Targeted Financial Sanctions (TFS) under UNSC Resolutions

- AML/CFT/CPF Regulations – Frequently Asked Questions (FAQs) on Targeted Financial Sanctions (TFS) Obligations

What if Central Banks Don’t Ask the Banks to Obtain KYC Form Information

Simply put, this may lead to financial chaos. The international community especially the FATF would hit hard on such a lax country. Therefore, the implications are immense and vaster.